Politics

PCI DSS v4.0 brings 13 new requirements to comply with

Content writer and editor

Updated

Jan 12, 2024

5 min

The new requirements to get the PCI DSS v4.0 certification include documenting, assigning and understanding roles and responsibilities for implementing security controls; verifying the scope of the PCI DSS assessment once every 12 months; performing a targeted risk analysis for every requirement met with the customized approach; and supporting customers' requests for information on PCI DSS requirement responsibility and compliance status. Compliance with these requirements is expected in a couple of months.

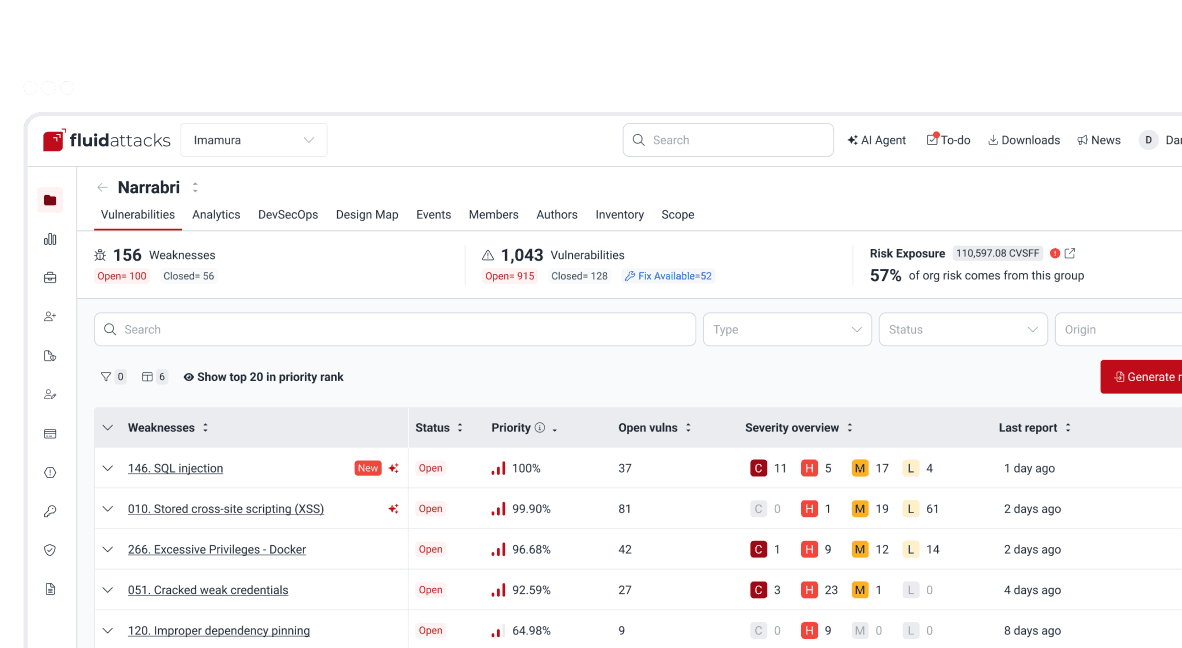

Let us give you a little bit of context. Entities that store, handle or transfer cardholder information are required to comply with the security requirements of the Payment Card Industry Data Security Standard (PCI DSS). Version 4.0 of the standard poses 64 new technical and operational requirements. These are distributed among the principal requirements, which are the 12 categories whose names provide us with a high-level overview. In the following image, you can see how their titles changed from v3.2.1 to v4.0.

Title changes in PCI DSS principal requirements from v3.2.1 to v4.0.

Companies need to start complying with 13 of the new requirements ASAP, as this version will take effect on March 31, 2024. The remaining 51 are considered best practices to start following during the year and will be mandatory starting March 31, 2025.

The penalties due to noncompliance may include sizable fines. These range from USD 5,000 to 100,000 each month depending on the firm's period of noncompliance and volume of transactions. Also, stakeholders may seize the firm's ability to accept card payment. Moreover, public knowledge of these events would have a detrimental effect on customer trust and the firm's reputation. With this in mind, as well as your purpose to keep your firm's and clients' data safe, let's look at what's new.

Documenting, assigning and understanding roles and responsibilities

Ten out of the 13 new requirements ask for documenting, assigning and understanding the roles and responsibilities for implementing security controls. In the prioritized approach formally presented by the standard, in case this is your first rodeo, it is suggested that fulfillment of this requirement be left for after other more basic ones in the principal requirement are achieved.

To summarize, these are our simplified versions of some of the requirements that your team should meet first and for which roles and responsibilities should be clear:

Build and maintain a secure network and systems: Resolve the issues of risky configurations in vendor default accounts, primary functions requiring different security levels, unnecessary functionalities, among others.

Protect account data: Implement data retention and disposal policies, procedures and processes to keep storage of account data to a minimum; use strong cryptography to keep primary account numbers safe; take measures to protect cryptographic keys; etc.

Maintain a vulnerability management program: Deploy antimalware solutions; develop software based on industry standards and best practices; analyze code for vulnerabilities and remediate them prior to releasing it into production; if conducting manual code review, have it done by individuals with vast knowledge about code-review techniques and secure coding practices; etc.

Implement strong access control measures: Define and assign access appropriately; use an access control system; implement MFA; use strong cryptography to render all authentication factors unreadable; restrict physical access to systems through appropriate facility entry controls; etc.

Regularly monitor and test networks: Enable, review and protect audit logs (i.e., the chronological record of system activities); conduct vulnerability scans; have internal and external penetration testing performed at least once every 12 months; etc.

Maintain an information security policy: Document and implement acceptable use policies for end-user technologies; document and validate the scope of the PCI DSS review; monitor third-party service providers' PCI DSS compliance; etc.

_____

PCI DSS v4.0 introduces the category "account data," instead of just "cardholder data," to refer to the primary account number (PAN) and any other elements of two categories: cardholder data and sensitive authentication data. The former includes the PAN, cardholder name, expiration date and service code; the latter includes full track data, card verification code and PINs/PIN blocks.

_____

Later, as we grasp it, your team can work on the actual documentation within policies and procedures or a dedicated file. However, to us, the prioritization advice seems fitting only for creating the documentation, since roles and responsibilities should be assigned formally and understood for the actual security controls to be put in place.

Further advice given in the file is the creation of a RACI matrix. It is so called as it displays who is responsible, accountable, consulted and informed.

New for maintaining an information security policy

The three new remaining requirements due in 2024 are linked to the organizational policy and programs to support information security.

Out of these requirements, the one to meet first is documenting and confirming the scope of the PCI DSS review at least once every 12 months. This means your team has to verify that the locations and flows of account data and the system components (e.g., software, cloud components, network devices) to be protected are added to the scope of the review.

The advice is to create a spreadsheet and record

where the data is stored, why and for how long;

what data is stored (i.e., elements of cardholder and/or sensitive authentication data);

how the data is secured;

how access to the data is logged.

Moreover, your team should identify not only your internal systems and networks but also all connections from any third party.

One more new requirement is performing a targeted risk analysis for every requirement met with the customized approach. To be clear, entities pursuing certification can follow either the defined or the customized approach. Whereas the defined approach means implementing the security controls just as the standard describes them, the customized approach involves reaching the objectives of requirements without necessarily applying the exact technologies or operations spelled out in the standard. To qualify for the latter, an entity must "demonstrate a robust risk-management approach to security" (e.g., having a dedicated risk management department).

If your team meets PCI DSS requirements with the customized approach, then you will have to do a risk analysis for each of those items at least once every 12 months. That is, you will need to define in detail what would be the effect on security if the requirement is not met and say how the controls you apply provide the needed protection. The signature of a member of executive management must be present to certify that they reviewed and approved the strategy. There is a sample template in the document to help you know the elements of the analyses you need to report.

The last new requirement due this year is directed only at third-party service providers (TPSPs; i.e., businesses for which PCI DSS applies but who are not a payment brand), such as payment gateways. Some clarity is needed first. An entity depending on TPSPs needs to monitor the latter's PCI DSS compliance and maintain information on which requirements each has to meet.

The requirement is then for TPSPs to support customers' requests for information on PCI DSS requirement responsibility and compliance status. This will help the entity pursuing compliance meet the requirements mentioned above.

TPSPs can provide the customer with their PCI DSS Attestation of Compliance (AOC). And when TPSPs are not certified, at least they may provide the customer's assessor with specific evidence of their compliance with PCI DSS requirements.

Fluid Attacks analyzes your compliance with PCI DSS requirements

We test your software to verify PCI DSS compliance. Our flagship plan offers vulnerability scanning with multiple techniques, manual code review by our pentesters, vulnerability management on our platform, and expert and AI-assisted vulnerability remediation. We help you secure your software from the beginning of development and before you release it into production or to customers, which is in line with PCI DSS requirement 6.

If you want to test our tools first, start a free trial.

Get started with Fluid Attacks' compliance solution right now

Other posts