Philosophy

Securing online payment systems

Writer and editor

Updated

Jul 25, 2024

5 min

As a developer of digital payment systems, you are entrusted with protecting some of the most sensitive data: your users’ financial information. Every online transaction is a demonstration of trust from the customer to your institution. That's why it is imperative to provide a secure digital platform where customers can input their financial information without fearing that their data might be compromised. A single security incident can lead to severe effects, such as diminished trust among users, monetary losses and increased audits from regulatory authorities.

An important component of a company's payment flow is the payment gateway, as this is the passageway for transactions. Payment gateway security is crucial for businesses because it protects customer data from breaches and internal leaks. It prevents fraud like money laundering and identity theft. It also ensures compliance with industry regulations. And something that financial institutions highly value: it reduces chargebacks from fraudulent transactions.

It is up to you, the developer, to implement effectively the numerous security measures that are available. You must use best practices to address the evolving threat landscape and balance security with user experience, all while managing cost and resource constraints. Although it may seem challenging, it is achievable and, more importantly, essential for maintaining customer trust. This trust is the foundation for a loyal customer base and fostering long-term business partnerships.

It’s always wise to understand the challenges you face, so let’s begin there.

Cybercriminals vs. payment gateways

Malicious actors are constantly devising new tactics, targeting everything from login credentials to payment card data on landing pages with payment forms. Even seemingly minor security lapses, like weak password requirements or unencrypted data transmission, can create a backdoor for attackers. There are several ways attackers can infiltrate, bypass or even impersonate a payment page. Here are some threats to be aware of:

Phishing attacks: Attackers can create fake payment pages that mimic legitimate websites to steal personal information from users.

SQL injection: Attackers could exploit vulnerabilities in a website's database to inject malicious SQL code, gaining access to or manipulating sensitive information such as payment details.

Cross-site scripting (XSS): Malicious scripts can be injected into a website’s payment page, which can lead to stolen cookies or session tokens.

Man-in-the-middle attacks: Attackers can intercept communication between the user and the payment page, allowing them to capture sensitive data.

Credential stuffing: Attackers could use stolen usernames and passwords from data breaches to gain access to user accounts.

Distributed denial of service (DDoS): These attacks flood payment systems, causing them to malfunction and be unavailable to users.

Formjacking: Cybercriminals could inject malicious JavaScript code into genuine websites to control the operation of the site's forms, which may intercept payment forms.

Unsecured data transmission: Payment data transmitted over unsecured or improperly encrypted connections can be intercepted by attackers.

Exploiting third-party services: Breaches can occur through vulnerabilities in vendor services integrated with the payment system, such as payment processors or plugins.

Essential security measures

While there are many ways threat actors can attempt to attack your payment gateway, there are also effective methods to protect it. The implementation of robust security measures make a significant difference. A proactive approach to payment security benefits not only customers but also credit card providers and other financial institutions. These are some key strategies to prevent risks and create a secure online payment processing environment.

Multi-factor authentication

A “secure password” alone is no longer sufficient. Implement multi-factor authentication (MFA) for both users and employees. This adds an extra layer of security. Require users to provide at least a second verification factor, like a code sent to their phone or a fingerprint scan, to access accounts and especially before completing transactions. This also applies to administrators and employees within your institution. Fortifying access to your back-end systems with MFA significantly reduces the risk of unauthorized intrusion.

Encryption

By employing robust encryption protocols like SSL/TLS (Secure Sockets Layer/Transport Layer Security), you render information useless even if intercepted by attackers. Such encryption ensures the confidentiality of sensitive information like credit card details throughout the entire transaction process. Additionally, encrypt sensitive data stored on your servers to add another layer of defense. Encryption can be enabled with an SSL certificate, establishing a secure connection between a user's browser and a website. By displaying the public padlock icon and “https” in the address bar, the user experience is enhanced.

PCI DSS compliance

The Payment Card Industry Data Security Standard (PCI DSS) is your blueprint for building a secure payment infrastructure. PCI DSS compliance ensures you're implementing best practices and handling cardholder data security with the utmost care. Some PCI DSS requirements that heavily influence secure online transactions include:

3.2 Storage of account data is kept to a minimum.

3.6 Cryptographic keys used to protect stored account data are secured.

5.2 Malicious software (malware) is prevented, or detected and addressed.

7.3 Access to system components and data is managed via an access control system(s).

8.3 Strong authentication for users and administrators is established and managed.

8.2 User identification and related accounts for users and administrators are strictly managed throughout an account’s lifecycle.

Tokenization

Replace a user's credit card information with a unique token, a sort of digital alias. That's the essence of tokenization. This approach keeps the actual card details out of your system, significantly reducing the risk of a breach. Tokens retain essential information needed for transactions but are useless without the decryption key.

Web application firewall

This firewall filters and monitors all incoming traffic to your web application. A WAF effectively blocks malicious requests and prevents attacks from reaching your servers.

Audits and penetration testing

Regular security audits and penetration testing are crucial for identifying and patching vulnerabilities in your payment gateway. Think of them as preventative measures to expose weaknesses before they can be exploited by attackers. Additionally, use automated security monitoring tools for continuous vigilance.

Secure coding practices

The foundation of your secure gateway is built with secure coding practices. Providing your development team with the knowledge to write code that is resistant to common attacks like SQL injection and cross-site scripting (XSS) is extremely important. Techniques like using prepared statements with parameterized queries further strengthen the code's defenses.

API security and access controls

APIs are used as passageways that connect the payment gateway to other systems. Ensure API security and follow best practices like using API gateways and rate limiting to prevent unauthorized access and overwhelming traffic. Also, implement strict access controls within your system. Limit who can access sensitive data and systems based on the principle of zero trust.

User education

This is a crucial piece of the puzzle. Educate your users about security best practices. This includes recognizing phishing attempts, using strong and unique passwords and being cautious about sharing personal information online.

Payment page improvement with Fluid Attacks

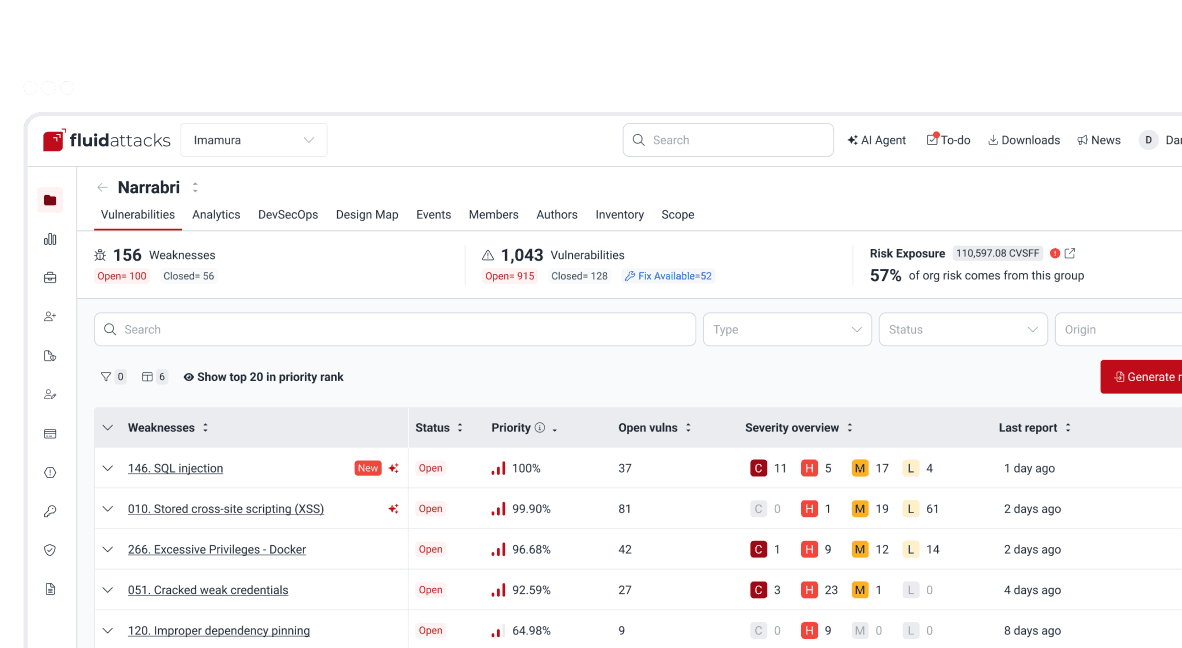

Continuous Hacking is a valuable tool for organizations to stay ahead of evolving threats and shrewd cybercriminals. By proactively identifying and addressing vulnerabilities, you can reduce the risk of successful attacks and protect your company’s digital assets.

Our Continuous Hacking solution is able to detect several vulnerabilities that affect the integrity of your online payment app. For instance, we can identify non-encrypted confidential information (credit cards, credentials, other confidential information). Also, we can identify insecure encryption algorithms (e.g., an outdated TLS protocol) and use of insecure channels (like HTTP). Other vulnerabilities like an insecurely generated token or an error-based SQL injection can also be uncovered by our solution. Along these are many other vulnerabilities that could be exploited by attackers but we are able to detect them. Find them all here.

We’re here to help you by prioritizing our findings, which can help you accelerate your mitigation efforts. Our AI optimizes the constant search for vulnerabilities and our expert hackers provide actionable solutions to address your most urgent weaknesses. Explore our Advanced plan to assist with all these services and more. Contact us to get started.

Get started with Fluid Attacks' PTaaS right now

Other posts