Philosophy

Data privacy in open banking: Details on this trend

Writer and editor

Updated

6 min

Data protection is crucial for the banking industry. As we pointed out in one of our previous blog, strong data protection is not only a way to stay compliant with regulatory requirements or to avoid penalties, but it also minimizes the risk of data breaches and other consequences of cyberattacks. It also helps maintain customer trust, which can be destroyed by security incidents. Moreover, data protection reduces financial losses from ransomware attacks, downtime, and data recovery. That is why data protection is essential: it safeguards multiple aspects.

Data protection encompasses practices, technologies and regulations aimed at ensuring the availability, security and privacy of information. But things like cybercriminals, human error, insider misuse and external pressures such as government actions and hacktivism pose threats to data protection. Cybersecurity teams must tackle these challenges to protect their institutions' customer data.

The changing landscape in this industry brings new challenges for development teams. Open banking, with its emphasis on data sharing, introduces new complexities. Privacy in open banking has become one of the most pressing "now what?" questions for data protection. We’ll explore this issue further.

First, let’s dive into this relevant trend of open banking.

Bright new world of open banking

In contrast to open banking, a closed or traditional banking system is one in which financial data is kept within individual databases and is not shared with other institutions or third parties. In this system, customers' financial data is typically isolated, with limited sharing between banks and other financial services. The primary focus of data treatment in traditional banking is on data privacy and security. However, it lacks the transparency and accessibility that open banking aims to provide.

Open banking advocates for a more integrated system in which banks share data securely with authorized third parties. This is meant to encourage competition and innovation in financial services, offering more personalized services like budgeting tools and financial advice. It also wants to give customers greater control over their data. By allowing third-party providers (TTPs) access to customers’ banking data –with their previously granted consent– customers would have all their financial information ready and available in one place.

Types of data shared in open banking

Data covered by the open banking initiative includes the following:

Account Information: Balances, transaction histories, and details.

Account Terms: Conditions, fees, and interest rates.

Billing Information: Upcoming payments and online transactions.

Credit and Loan Details: Credit scores, reports, and loan histories.

Personal Information: Basic data like name, address, and contact details.

Current state of open banking

Regulations

Open banking is being adopted globally, with significant implementation in regions like the European Union, the UK, Australia and parts of Asia. The United States and parts of Latin America, like Brazil and Mexico, are advancing in open banking. However, the pace and approach differ significantly in each country. From advanced frameworks in Brazil to emerging or absent regulations in other regions. Overall, open banking is generally accepted in countries with strong regulatory frameworks supporting data sharing and customer rights.

To ensure consumer protection, open banking is often regulated. In the U.S., the Consumer Financial Protection Bureau (CFPB) regulates open banking, ensuring that authorized providers adhere to stringent security standards. In the EU, it's governed by the Payment Services Directive 2 (PSD2). In the UK, it's regulated by the Open Banking Implementation Entity (OBIE). Australia has the Consumer Data Right (CDR) to protect consumers’ data.

In the U.S., open banking must adhere to several regulations and standards to ensure customer protection:

Data minimization: Limiting data collection to what is necessary.

User consent: Clear guidelines for obtaining and managing consumer authorization.

Strong customer authentication (SCA): Implementing measures like multi-factor authentication.

Anti-fraud measures: Monitoring and preventing fraudulent activities.

For third parties to have authorized access to financial data, they must obtain explicit consumer authorization. This authorization must detail the data being accessed, its purpose and any third-party involvement. TTPs can only use the data for the specified service, and authorization must be renewed every 12 months. They must also comply with the Gramm-Leach-Bliley Act's (GLBA) security requirements or the Federal Trade Commission’s (FTC) Safeguards Rule.

Benefits of open banking

Open banking provides financial institutions with opportunities for growth and efficiency. It streamlines processes and reduces costs through automation to contribute to overall operational efficiency. A variety of third-party companies use open banking. New-age technologies like fintech firms leverage access to banking data to provide more tailored financial products and services. From budgeting apps and payment services, to credit assessment tools and investment platforms.

Customers benefit from open banking through increased choice, personalized financial management, and improved access to financial services. Increased choices that compete for the customer’s business forces institutions to improve their offerings. This hopefully leads to better services. The availability of innovative tools and products allows customers to make informed decisions about their finances. Moreover, the necessary transparency in data sharing practices and clearer financial options also enhance the overall customer experience.

Challenges and privacy concerns

Despite its benefits, open banking raises concerns about data protection and consumer consent. Entities must ensure that data is shared securely and that consumers are fully informed about how their data is used. Compliance challenges arise as banks need to navigate varying regulations across regions and maintain robust privacy practices.

One particular concern is that of the potential use of data to train AI to manipulate consumer behavior. For example, AI might be trained to analyze spending habits and target consumers with tailored marketing ads, or influence them to buy things they don’t need. Algorithms could potentially influence consumer behavior in ways that are not necessarily beneficial for them.

Security concerns rise with the integration of open banking. For organizations, internal restructuring is necessary to integrate new technologies and define responsibilities, which can create potential security gaps if not managed correctly. The presence of TTPs is an added risk. Supply chain attacks perpetrated by malicious actors who may exploit these providers pose a legitimate threat. Protecting various endpoints (such as tablets, laptops and IoT devices) remains a critical and challenging aspect of open banking security.

For developers, there are other challenges being faced. Many banks are reluctant to move away from their existing legacy software systems, and the trend is for banks to use APIs. Adoption can be problematic because it requires significant investments in resources, staffing and financial commitments. In addition, creating a unified framework for APIs is a draining task as an API needs to work across different banks, third-party providers and regions. All of these poses a substantial technical challenge.

Proactive measures for financial institutions

By implementing these measures, developers can contribute to a more secure and trustworthy open banking ecosystem:

In terms of compliance and regulations, it is essential to follow established open banking regulations. Regulations like PSD2 and GLBA ensure data security and consumer protection.

Continuous API monitoring systems to detect suspicious activity related to data access can be implemented. Keep tabs on the API’s response time, error frequency, latency, the number of requests the API can handle and other key metrics.

Microservices architecture allows for the development of modular, independent components that can be deployed and updated separately. It eases data sharing and third-party integration.

It is essential to design systems that give users clear control over their data (access, usage and storage), which in turn, fosters trust.

Advanced authentication and authorization can be achieved through the use of multi-factor authentication (MFA) like strong passwords and biometrics.

Strong data encryption is necessary to secure sensitive information during both transfer and storage.

Data minimization can be put in practice by identifying and removing unnecessary or excessive data collection. This reduces storage costs and risk of compromising sensitive data.

It’s important to implement permission-based and risk-based data sharing, with their respective audits.

Information sharing and cooperativeness within the financial industry are essential for identifying and addressing threats.

A secure digital platform should be established for data exchange with third-party providers.

Regular monitoring is crucial for identifying weaknesses and potential security risks. The implementation of continuous penetration testing can strengthen data access. Additionally, content filtering and vulnerability management strategies should be employed to protect APIs.

Education for customers about open banking, consent management and potential risks should be administered.

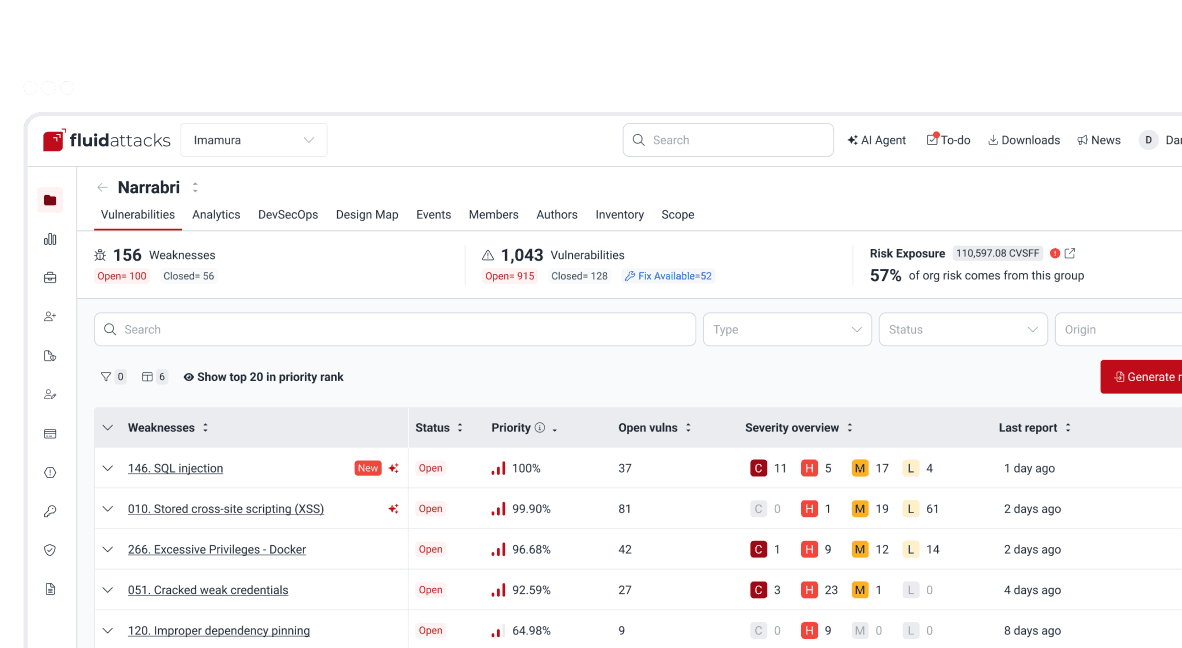

Fluid Attacks' role in this ecosystem

Open banking holds immense potential, but cybersecurity teams must be prepared to manage the associated risks. Adopting a proactive approach, like that facilitated by using our Continuous Hacking solution, can help extremely helpful. Our solution identifies vulnerabilities and helps you in their remediation via AI or expert support throughout your software development lifecycle. Your team can quickly react and not put your customers’ data at risk. Leverage our innovative solutions to maintain a robust security posture, essential in the open banking ecosystem.

Choose us to evaluate several kinds of systems. For example, with our tools and pentesters, we proactively identify vulnerabilities in APIs and microservices, which are vulnerable to attacks within this open banking trend. By continuously testing these access points, you can stay ahead of cybercriminals and ensure the security of your customers' financial data. Contact us now.

Get started with Fluid Attacks' RBVM solution right now

Other posts