Philosophy

Cybersecurity in banking: With great convenience comes increased risk

Writer and editor

Updated

Jun 20, 2024

7 min

Like many other industries, banking has been gradually undergoing a digital transformation in recent years. This digital revolution has brought new and exciting opportunities, for both businesses and individuals. The convenience of online banking is undeniable. With a few clicks, you can check balances, transfer funds or pay bills.

However, with great convenience comes great responsibility, especially when it comes to cybersecurity. Banks are constantly under siege from attackers looking to exploit vulnerabilities and steal customers’ hard-earned money or information that could be leveraged in a ransom or sold on the dark web.

Cyberattack stats and consequences in banking

Statistics and recent incidents paint a picture of the current landscape being faced by banks. They, along with other kinds of institutions in the financial industry, are prime targets for cybercriminals. Here is what the stats report:

A 2023 DDoS report informs that one-third of all distributed denial-of-service (DDoS) attacks were directed at the financial sector, making it the most targeted industry.

A report by Sophos about the state of ransomware attacks indicated that financial services, including banks, continue to be a highly targeted market, going up from 55% in the 2022 report to 64% in the 2023 report.

IBM’s 2023 Cost of a Data Breach Report estimates that the average cost of a cyberattack on a financial institution is approximately $5.9 million.

Between 2019 and 2020, financial services around the world were fined $10.4 billion by regulatory entities for noncompliance.

Fortunly reported that 92% of ATMs are vulnerable to attacks.

U.S. regulators fined the bank Capital One $80 million after a data breach in 2019. The data breach exposed the information of around 100 million users in the U.S. and about 6 million in Canada.

The repercussions of successful cyberattacks on banks can be profound. There's always the possibility of financial loss associated with stolen funds, ransom payments, attorney fees, recovery expenses, among others. Banks may face hefty fines for regulatory violations as well. Another repercussion is the downtime from an operational disruption. Reputational damages, a decline in trust and loss of customers are the less than desirable but most likely consequences a bank could face after an incident.

Cybersecurity regulations in banking

Banks operate under rigid regulatory frameworks that are meant to ensure the security of financial systems, including the protection of customer data. Regulatory entities change from country to country, but they all look for ways to protect the end-customer.

For example, in the United States, there are several mandatory regulations to comply with, like:

The interagency authority FFIEC (Federal Financial Institutions Examination Council)

The policies and standards for cardholder protection PCI DSS (Payment Card Industry Data Security Standards).

The European Union has the GDPR (General Data Protection Regulation) that determines how data is used and protected for EU citizens.

The UK has its equivalent, the Data Protection Act.

Singapore has the regulatory agency MAS (Monetary Authority of Singapore).

Canada has the OSFI (Office of the Superintendent of Financial Institutions).

And so on.

Compliance with these and other regulatory bodies requires constant updates to protocols that should include preventive security testing, comprehensive incident reporting and regular audits, thus ensuring robust cybersecurity measures that banks need to follow.

Banking cybersecurity challenges

Banks traditionally operate with separate departments which use different systems and try to reach their own goals. This lack of integration has hindered growth, restricted scalability, diminished customer satisfaction and facilitated the propagation of security vulnerabilities.

The current banking landscape involves a vast network of interconnected technologies, which include mobile platforms to cloud services. This linkage enlarges the attack surface (i.e., creates many potential entry points for cybercriminals). Other circumstances, like an increase in reliance on digital channels, customizable cloud environments, and the usage of third-party software, have also created a larger attack surface.

Other challenges are fueled by several factors. Outdated legacy systems and a lack of proficiency by an unprepared staff need to be considered. Evolving cybercrime tactics like social engineering and spear-phishing attacks, advanced tools like exploit kits, and even machine learning manipulated to leverage vulnerabilities are also contributing factors to the proliferation of cyber threats.

Importance of cyber hygiene in banking

A culture of cyber hygiene in banks fosters a more secure digital banking environment. It seeks to protect valuable assets, maintain customer trust, meet regulatory requirements and ensure operational stability. It’s more than just implementing technical solutions; it’s about creating a shared responsibility where both employees and customers understand the importance of good cybersecurity practices. This collective approach is vital to prevent data breaches, malware installation, and other incidents that can disrupt banking services.

Banking cyber hygiene

Here are key practices to cultivate robust cyber hygiene within a bank institution:

Robust security framework: Implement a comprehensive security framework like NIST Cybersecurity Framework or ISO 27001. These frameworks provide a structured approach to identify, protect, respond to and recover from a cyberattack. Another framework that we recommend is the Zero Trust Security Model, and its solution ZTNA. Zero trust is based on principles like least privilege, continuous authentication and monitoring microsegmentation and breach assumption. All of these add up to enhance a bank’s cybersecurity posture.

Regular risk assessment: Conduct regular risk assessments to identify potential threats to the IT infrastructure, applications and processes, as well as their impact and likelihood. This will help create a risk management strategy that contributes, among other things, to prioritize and manage vulnerabilities quickly and effectively.

Data privacy as a priority: One of the main concerns of regulations and laws is this item. Data protection includes several processes and practices that we discussed in another blog post.

Multi-layered security: Implement a layered defense with firewalls, intrusion detection systems, data encryption and the highly recommended MFA. Multi-factor authentication adds an extra layer of security as it goes beyond passwords. It requires multiple forms of authentication, and it can be required of employees, customers, and even suppliers.

Continuous monitoring and testing: Continuously monitor network activity and security systems for vulnerabilities so they can be promptly detected and addressed. This includes regular penetration testing (which is mandatory in some standards, e.g., PCI DSS, SWIFT CSCF) and vulnerability scanning. Both are solutions provided by Fluid Attacks, with its pentesters' expertise adding to the scanning capabilities of its automated tool.

Incident response plan: All banks should have an established and clear incident response plan that outlines procedures for detecting, containing and recovering from cyberattacks.

Third-party vendor management: Before granting access to any system, evaluate the cybersecurity posture of vendors the bank is considering working with. Financial institutions need to ensure the vendor’s security aligns with their own.

Constant updating: Maintain a culture of continuously updating systems with the latest patches and configurations.

Employee training: Regularly train staff on cybersecurity best practices, phishing awareness and social engineering tactics to minimize human error.

Customer education: Educate customers about online security threats and motivate them to protect themselves with informative emails. Promote secure practices such as using strong passwords and enabling MFA and provide them with information about phishing emails or phone calls.

Checklist for security assessment

Security leaders can ask themselves and their teams questions like the following to assess their bank’s cybersecurity posture:

Are regular risk assessments, vulnerability scanning and penetration tests being conducted?

Are the correct access controls implemented to restrict access to sensitive information?

Is end-to-end encryption ensured for all data, both in transit and at rest?

Is MFA implemented in all critical systems?

Are all software and systems continuously updated and patched?

Does the bank have a robust incident response plan that includes communication outlines and post-attack procedures in order to address the cyberattack?

Are employees trained to recognize and report any cyber threat?

Are the different departments within the bank aware of their shared responsibility for cybersecurity?

Does the board of directors include individuals who possess knowledge about cybersecurity?

Risk mitigation in bank application development

Building security into the fabric of bank applications from the very beginning is fundamental to mitigating cyber risks. Risks can be identified early on in the software development lifecycle (SDLC) by integrating security factors. This can include preliminary analysis to understand the bank’s needs and threat modeling exercises to identify potential vulnerabilities.

Another way to mitigate risks is to implement coding standards that prioritize security, as well as conduct constant code reviews to identify and fix vulnerabilities early. Fluid Attacks secure code review provides the combined power of both secure code review tools and manual code review. This allows for early and accurate identification of weaknesses and their prompt remediation.

Other developing mitigation strategies could include creating plans to mitigate risks and adopting a secure development model like OWASP’s risk assessment framework to provide a structured approach. Using well-vetted open-source software and libraries helps prevent extra risks.

Finally, integrating security testing into the CI/CD pipelines and failing such pipelines if code flaws are found can help catch vulnerabilities and remediate them before they are deployed. This can save everyone time and money that would otherwise go to remediation expenses.

Fluid Attacks' solution for the banking sector

The challenges and threats lurking around banks are not going to end. They’re getting more intricate and less easy to catch. Instead of waiting for attackers to exploit vulnerabilities, banks can adopt a solution like the one we offer. Our proactive approach to vulnerability management has helped banks to continuously improve their security posture and stay ahead of ever-changing cyber threats.

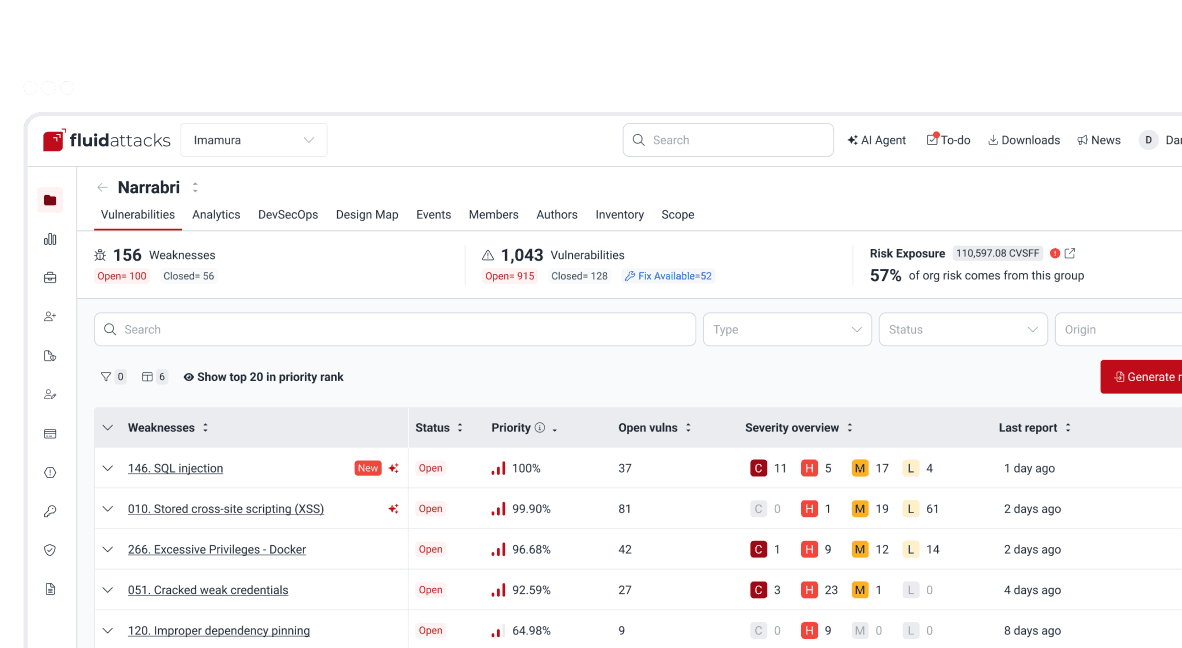

Our Continuous Hacking solution is the ideal AppSec choice for banks. Our comprehensive solution uses not only automated vulnerability scanning tools like SAST or SCA but also leverages AI as well as our pentesters to identify and exploit vulnerabilities throughout the SDLC. As previously mentioned, the earlier we identify and report a vulnerability, the more protected your application is. Speaking of reporting, the visibility our platform provides is extensive. Managing vulnerabilities becomes easier as you can learn about the security issue, its severity and location, prioritize it, assign it to your team and even get remediation suggestions from our pentesters. Get to know our platform.

Because we seek to streamline your developers’ workflow, our platform integrates seamlessly with existing systems, which enhances the efficiency and scalability of the vulnerability management process. With our integration features, you can create issues from GitLab, Azure DevOps or Jira automatically, find security issues in your AWS or GCP cloud environments, and use the VS Code extension to take you to the specific line of code where the vulnerability was discovered, leverage gen AI to get fix suggestions, and more. See what extensions may work for you.

The journey to a robust cybersecurity posture is ongoing, repetitive, requires vigilance, adaptability and commitment. We, at Fluid Attacks, want to be part of your journey. Contact us and let us show you what we can do for you.

Get started with Fluid Attacks' RBVM solution right now

Other posts