Philosophy

Quantifying risk: From color scales to probabilities and ranges

Security analyst

Updated

Feb 19, 2019

5 min

One of the least understood parts of a vulnerability is the risk it poses to the target. On the client side, it tends to get confused with impact and occurrence likelihood, due to devices like the so-called "risk matrix," which are supposed to help us better understand risks:

Risk "matrices". Via Safestart.

Discrete scales such as this have the obvious disadvantage that they can’t be added or mathematically operated with in a sensible way; they can be compared, but only crudely: how do 3 lows and 4 mediums compare to 2 highs? It is also hard to turn any of these into money terms.

While in other sectors, like insurance and banking, risk is measured quantitatively and thus converted into dollars and cents, we are content with leaving the treatment of security threats, basically, to chance, by using these inaccurate scales for scoring risk.

But better methods exist in actuarial science, statistics, game theory, and decision theory, and they can be applied to measure cybersecurity risk.

Among the main reasons why these methods are not widely accepted in the field are:

Security breaches are rare, so we can’t possibly have enough data to analyze. It wouldn’t be ``statistically significant''.

We do not see how we can measure risk, or even understand what measuring is nor what it is that we want to measure, nor how.

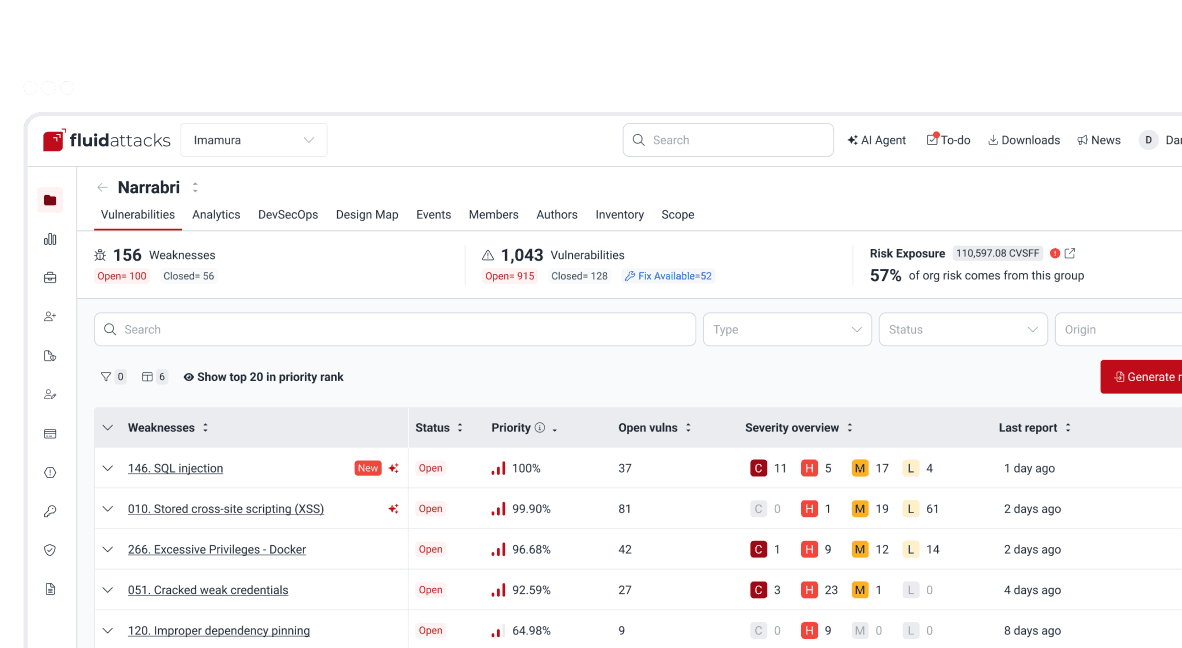

Before going into ground definitions, let me show you what we can achieve by applying quantitative methods to risk measurement:

Loss Exceedance Curve.[1]

This curve tells you the probability of losing any amount of money or more. Thus from the graph, we can read that the probability of losing $10 millions or more is around 40%, but losing more than $100 is unlikely at around 15%. You can enrich it with your risk tolerance (what is the probability that you can accept to lose n millions?) and the residual risk shows how the risk is mitigated by applying some controls. With this kind of tools, you can make more informed decisions regarding your security investments. If such a level of detail interests you, please read on.

Measuring requires specification

First, we need to define what we want to measure. Is it possible to measure the impact of a breach on my company’s reputation? Is reputation even measurable? What makes some things measurable and others not? Well, we need to be able to assign a number to it. But also no measurement can represent reality or nature with 100% accuracy, so there must be some uncertainty in measurement. Uncertainty is inherent to measurement.

In the lab, the length of an ant could be reported as 1.2 cm plus or minus 0.1 cm, which yields an interval: the real size of the ant is somewhere between 1.1 and 1.3 cm. There might also be some error due to random mistakes or improper use of the measuring device, so we can assign a confidence of, say, 90%, to this measurement. Observations reduce the uncertainty in a quantitative way. At first, we might have estimated the length of the ant to be between, say, 0.5 and 3 centimeters, with 60% confidence. After measurement, we have less uncertainty.

Thus, what we think is intangible or unmeasurable could actually be measured. Continuing with the reputation example, this might be measured indirectly by the drop in sales, or by the costs incurred in trying to repair the reputation damage. Another possibility for measuring could be decomposing the problem into smaller ones. For example, instead of trying to directly estimate the cost of a security breach, you might break it up into affectation to confidentiality, integrity, and availability. How many records could be stolen or wrongfully modified? What is each of them worth? For how long could our servers be out of service? How much money would be lost per hour?

Furthermore, events like these need to be time-framed. It doesn’t make much sense to ask "how likely is it that our organization suffers a major data breach?" because, given unlimited time and resources, it is almost certain to happen. Plus, we probably don’t care if it were to happen eons from now. We need to set a reasonable time frame, like a year. Once we achieve a result such as

There is a 40% chance of suffering a successful denial of service lasting more than 8 hours in the next year.

If such a denial of service happens, there is a 90% chance the loss will be between $2 and $5 million.

We could indirectly compute what might happen in 2 or any number of years.

Finally, there is the issue of not having enough data to perform measurements or estimations, or rather, thinking we don’t have enough data. That is not the case or, if it were, then the established qualitative methods like assigning arbitrary names on a scale of 1 to 5, are just as inappropriate or more, actually introducing noise or error.

Subjective probability

The ultimate goal will be to perform a simulation of random events, also known as Monte Carlo simulations. This type of simulation runs many times on single events, and their happening or not happening is based on a probability distribution, and such distributions require parameters as input. These parameters usually determine the location and shape of the curve.

Some probability distributions.

These parameters are to be estimated by experts, just like they estimate risk on a scale from 1 to 5. Just as imprecise, perhaps, but the math performed with the distributions obtained from these parameters sort of rights the wrong in the initial guess. Actually, subjective probability estimation can be calibrated to a point where it can be done consistently and accurately.

Even if the estimates are completely wrong, the good thing is that they can be further refined by a simple rule from basic probability theory: Bayes rule. It involves the prior probabilities (i.e., our estimates or initial beliefs) and the posterior probabilities, the ones computed after observing a certain piece of evidence.

Without going into details, which we will leave for the next articles, it can be shown that, from five expert inputs, including the probability of a successful penetration test, and the probability of remotely exploitable vulnerabilities when the pen test is positive, that in that case, the probability of suffering a major data breach can go from a prior of 1.24% goes up to a resounding 24%. If the test is negative, it goes down to 1.01%. This shows, by the way, the benefit of a proper pen test regarding the value of information.

Later we will also discuss more advanced methods based on Bayes rule such as iteratively adjusting distributions, which allows making forecasts with very scarce data, and decomposing probabilities with many conditions.

This article merely pretended to be an introduction to the whole slew of methods that exist in other fields to estimate risk, uncertainty and the unknown, but have not been adopted in the field of cybersecurity. In upcoming articles, we will show in more detail how some of these methods work.

References

R. Diesch, M. Pfaff, H. Kremar (2018). Prerequisite to measure information security in Proc. ICISSP 2018.

B. Fischhoff, L. D. Phillips, and S. Lichtenstein (1982). Calibration of Probabilities: The State of the Art to 1980 in Judgement under Uncertainty: Heuristics and Biases.

D. Hubbard, R. Seiersen (2016). How to measure anything in cibersecurity risk. Wiley.

Get started with Fluid Attacks' RBVM solution right now

Other posts